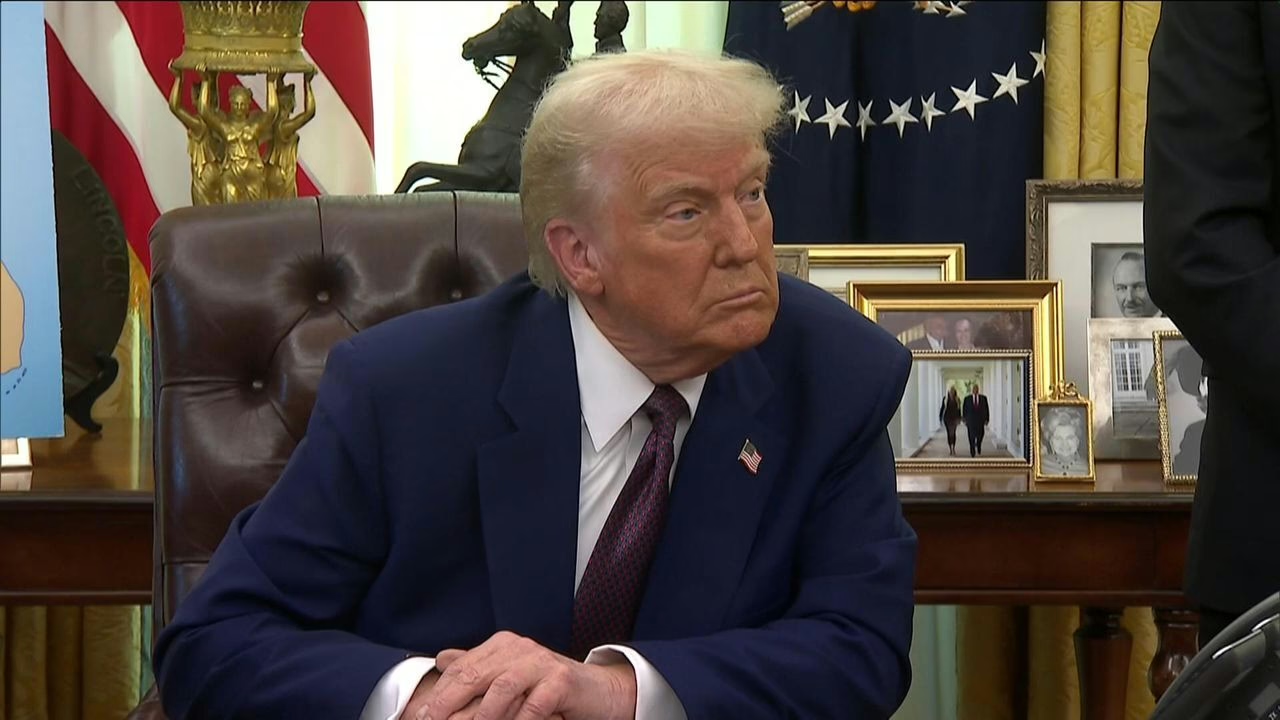

5 Ways Donald Trump Has Affected the Stock Market and the World Economy

Since his initial election in 2016 and subsequent re-election in 2024, President Donald Trump has implemented policies that have significantly influenced the stock market and the global economy. Here are five key ways his actions have left a lasting impact:

1. Tax Cuts and Deregulation: A Boost to Corporate Profits

One of Trump’s most significant economic policies was the Tax Cuts and Jobs Act of 2017, which slashed corporate tax rates from 35% to 21%. This move was widely celebrated by businesses and investors, as it led to higher corporate profits and increased stock buybacks. The policy fueled a surge in the stock market, with major indices like the S&P 500 and Dow Jones Industrial Average reaching record highs during his presidency.

Additionally, Trump’s administration rolled back numerous regulations across industries, including finance, energy, and healthcare. This deregulation was seen as a boon for businesses, reducing compliance costs and encouraging investment. While critics argued that these policies exacerbated income inequality and increased the federal deficit, supporters credited them with driving economic growth and boosting investor confidence.

2. Trade Wars and Tariffs: Disrupting Global Supply Chains

Trump’s “America First” trade policy was a defining feature of his presidency. He imposed tariffs on billions of dollars worth of goods from China, the European Union, and other trading partners, aiming to protect American industries and reduce trade deficits. While these measures were popular with some domestic manufacturers and workers, they sparked retaliatory tariffs and disrupted global supply chains.

The U.S.-China trade war, in particular, created uncertainty in the stock market and weighed on global economic growth. Companies reliant on international trade faced higher costs and reduced demand, leading to volatility in equity markets. However, Trump’s Phase One trade deal with China in early 2020 temporarily eased tensions and provided some relief to investors.

3. Energy Policies: Boosting Fossil Fuels and Impacting Global Markets

Trump’s energy policies focused on promoting fossil fuels and rolling back environmental regulations. He withdrew the U.S. from the Paris Climate Agreement, expanded oil and gas drilling, and supported the coal industry. These actions bolstered energy stocks and contributed to the U.S. becoming a net exporter of energy for the first time in decades.

While these policies benefited the domestic energy sector, they had mixed effects on the global economy. The increased supply of U.S. oil and gas contributed to lower global energy prices, which helped consumers but hurt oil-exporting countries. Additionally, Trump’s stance on climate change drew criticism from environmentalists and created friction with allies committed to reducing carbon emissions.

4. Immigration Policies

President Trump’s stringent immigration policies, including efforts to reduce the number of undocumented immigrants and restrict certain legal immigration pathways, have had complex effects on the labor market. While intended to protect domestic jobs, these policies have led to labor shortages in industries heavily reliant on immigrant workers, such as agriculture and construction, potentially driving up production costs and consumer prices.

5. Impact on Investor Sentiment and Market Volatility

Trump’s presidency was marked by his unconventional communication style, including frequent use of Twitter to comment on economic policies, corporate performance, and geopolitical events. His tweets often moved markets, with investors reacting to his statements on trade, interest rates, and individual companies.

While some investors appreciated Trump’s pro-business stance, others were wary of the uncertainty created by his unpredictable behavior. The stock market experienced heightened volatility during his presidency, driven by trade tensions, geopolitical risks, and shifting policy priorities. Despite this, the overall trend in equity markets was positive, with significant gains during his term.