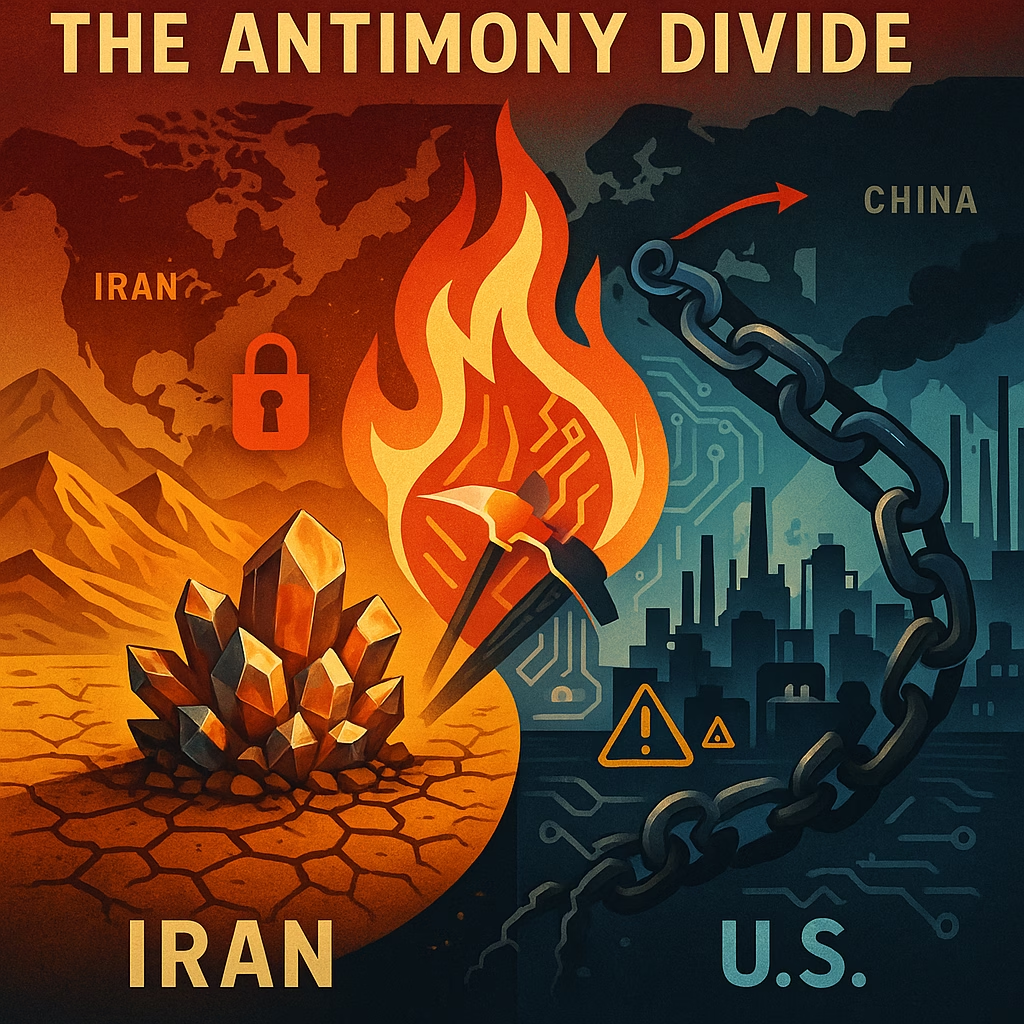

The Antimony Anomaly: Iran's Discovery Meets America's Supply Emergency

In the realm of critical minerals, antimony rarely captures headlines like lithium or cobalt. Yet, this brittle, silvery metalloid is the unsung hero enabling modern fire safety, military might, and green technology. Recent events – a significant discovery in Iran juxtaposed against a declared supply emergency in the United States – have thrust this obscure element into the spotlight, revealing stark geopolitical vulnerabilities.

Why Antimony Matters: More Than Just Matches

Antimony’s unique properties make it indispensable:

Flame Retardants: Its compounds (especially antimony trioxide) are crucial additives, making plastics, textiles, electronics, and building materials resistant to fire – saving countless lives.

Lead-Acid Batteries: Hardens lead in car and industrial batteries, extending their life and performance.

Military & Aerospace: Critical for ammunition primers, tracer bullets, night-vision goggles, and infrared sensors.

Semiconductors & Catalysts: Used in producing certain semiconductors and PET plastic.

Alloys: Strengthens lead (e.g., pipes, radiation shielding) and other metals.

Simply put, modern infrastructure, transportation, electronics, and defense systems rely heavily on stable antimony supplies.

Iran's New Find: A Geopolitical Game Changer?

In early 2025, Iranian state media announced the discovery of a “significant” antimony deposit in the country’s east. While official figures vary, initial reports suggested resources potentially exceeding 95,000 tonnes, positioning it as a major global find. For Iran, facing stringent international sanctions and economic pressure, this discovery holds immense potential:

Economic Lifeline: Offers a new revenue stream through potential exports or domestic industry development.

Sanctions Resilience: Reduces dependence on imports for its own industrial needs.

Geopolitical Leverage: Provides a valuable commodity to potentially trade with partners like China or Russia, bypassing Western sanctions.

Industrial Boost: Could support domestic manufacturing in batteries, flame retardants, and alloys.

However, significant hurdles remain. Developing a mine requires major investment, technical expertise, and time. Sanctions complicate access to necessary foreign technology and capital. Environmental concerns and infrastructure limitations in the region also pose challenges. While the potential is substantial, translating discovery into reliable, large-scale production is a long-term prospect.

America's Antimony Emergency: A Critical Wake-Up Call

While Iran eyes newfound potential, the United States faces a stark reality: an antimony supply crisis. In 2024, the US Geological Survey (USGS) designated antimony as a critical mineral, highlighting its essentiality to national security and economic well-being and its extreme supply chain vulnerability. Key factors driving the emergency:

Near-Total Import Dependence: The US produces zero primary antimony domestically. The last US mine (in Idaho) closed in 2001.

Reliance on Adversaries: Over 90% of US antimony imports come from China (refining ~80% of global supply), with smaller amounts from Tajikistan, Russia, Bolivia, and Guatemala. This creates severe geopolitical risk.

Fragile Global Supply Chain: Geopolitical instability, trade disputes, and China’s export control policies make the supply chain highly susceptible to disruption.

No Viable Substitutes: For many critical applications (especially flame retardants and military uses), antimony has no equally effective and economical replacements.

Stockpile Concerns: The US National Defense Stockpile holds antimony, but reports suggest levels are insufficient to weather a prolonged major supply disruption, especially for non-military essential uses.

The “emergency” isn’t about immediate physical shortage today, but the extreme vulnerability of a supply chain vital to national security, fire safety, and key industries. Any significant disruption – a conflict involving China, further sanctions on Russia, instability in Tajikistan – could cripple US manufacturing and defense readiness almost overnight.

The Irony and the Imperative

The situation presents a striking irony: Iran, heavily sanctioned by the West, discovers a potential new source of a critical mineral that the world’s largest economy desperately needs but cannot access due to sanctions and its own lack of domestic production.

This paradox underscores the imperative for the United States and its allies:

Accelerate Domestic Projects: Fast-track permitting and support for potential domestic antimony mines (e.g., projects in Idaho, Alaska, Nevada).

Boost Recycling: Significantly increase recovery of antimony from lead-acid batteries and flame-retardant waste streams.

Diversify Imports: Actively seek and develop reliable sources from allied or neutral nations (e.g., Australia, Canada, potential projects in Europe).

Strategic Stockpiling: Expand and modernize the National Defense Stockpile to cover broader critical civilian needs.

Research Substitutes: Invest heavily in R&D for alternative materials, though this is a long-term solution.